Search This Supplers Products:Magnetic materials, magnetic equipment and devicesAuto Partstelecom devicesElectronicselectricalsmetals

Australian rare earth miners work hard to advance development agreements

time2019/06/20

- Australian rare earth producers say they are expected to sign agreements with new customers that will move forward with their projects. Global concerns about the supply of rare earths are growing, and rare earths are critical to the high-tech industry.

Australian rare earth producers say they are expected to sign agreements with new customers that will move forward with their projects. Global concerns about the supply of rare earths are growing, and rare earths are critical to the high-tech industry.

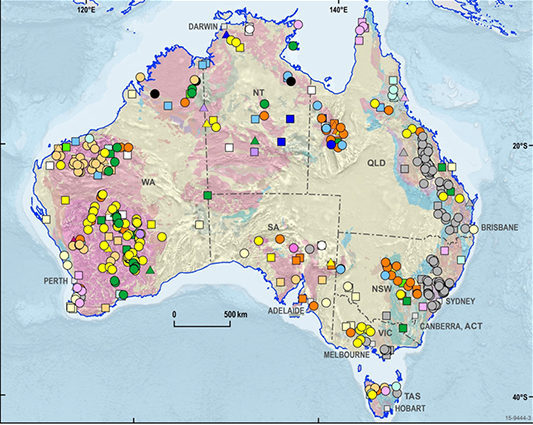

According to the United States Geological Survey, Australia accounts for only 2.8% of global rare earth reserves. However, according to data compiled by Curtin University's Western Australian Institute of Mines (WASM), Australia's new rare earth projects account for more than half of new global projects.

However, due to China's dominant position, most of Australia's projects are in trouble and it is difficult for developers to obtain financing. China accounts for about 90% of global rare earth processing capacity and accounts for a quarter of global reserves.

According to WASM data, the most promising projects are unlikely to start operating before 2023. However, these projects may accelerate as Sino-US trade conflicts escalate. 80% of the rare earths in the United States are imported from China. Some media reports said that China may reduce its rare earth exports to the United States.

Northern Minerals, which is developing the Browns Range project in northwestern Australia, said last week that it is negotiating with an internationally renowned industrial group on supply. A spokesperson for the company said investor interest has risen since the news attention on rare earth issues has increased.

Hastings Technology is preparing for its Yangibana Rare Earth Project in Western Australia and is scheduled to go into production by the end of 2021. The company has signed a preliminary supply agreement with Thyssenkrupp, Germany, and signed another supply agreement with automotive supplier Schaeffler AG last week. Charles Lew, executive chairman of the company, said the company is working on another German supply agreement that is expected to be finalized this year. In addition, Hastings received financing from a German strategic mineral procurement agency.

The outlook for the Australian rare earth industry is improving due to rising demand expectations. The United States said last week that it would hope that Australia and Canada will develop rare earth resources on a global scale to reduce dependence on China. A spokesperson for ThyssenKrupp said that in the field of rare earths, we regularly look for new partners to meet the growing global demand.

WASM professor Dudley Kingsnorth said that the reason why the rare earth projects outside China did not progress is because China's large production, coupled with cheap labor and less stringent environmental regulations, means that no other country can compete with the cost.

Australia's Lynas is the only rare earth producer outside of the world, which has enjoyed low-interest loans from the Japanese government. Last month, Lynas outlined an expansion plan, including the establishment of a processing plant in the United States.

Kingsnorth predicts that by 2025, 75,000 tons of rare earths will be needed every year in the world to be free from China's supply. However, he estimated that by that time, only the 50,000 tons of rare earths could be produced in other parts of the world except China. He said that end users are reluctant to invest in mineral projects that are years away from production and cost more than China. However, he said that the company did not factor in the risk of supply disruptions due to political factors. Kingsnorth said: This has nothing to do with China's competition, the key is whether to obtain the required metal.

An analyst at a resource company said that without new government support, it is difficult to see the dawn of most new projects. He said that especially if the company plans to build a processing plant, its cost may be an order of magnitude greater than the company's own value. For example, Australian crude oil miner Arafura Resources, with a market capitalization of A$77 million ($53.24 million), is seeking $1 billion in funding for a project that includes a processing plant.

Alafra and another mining company, Alkane Resources executives said that in February this year, as a member of the Australian trade mission, they held talks with US Defense Department officials, but they all returned empty-handed. Nick Kanner, managing director of Alkane, said: The challenge now is whether people are willing to put money in place to pay higher costs to reduce risk.