Search This Supplers Products:Magnetic materials, magnetic equipment and devicesAuto Partstelecom devicesElectronicselectricalsmetals

Analysis of the global production capacity trend of rare earth mines

time2021/04/28

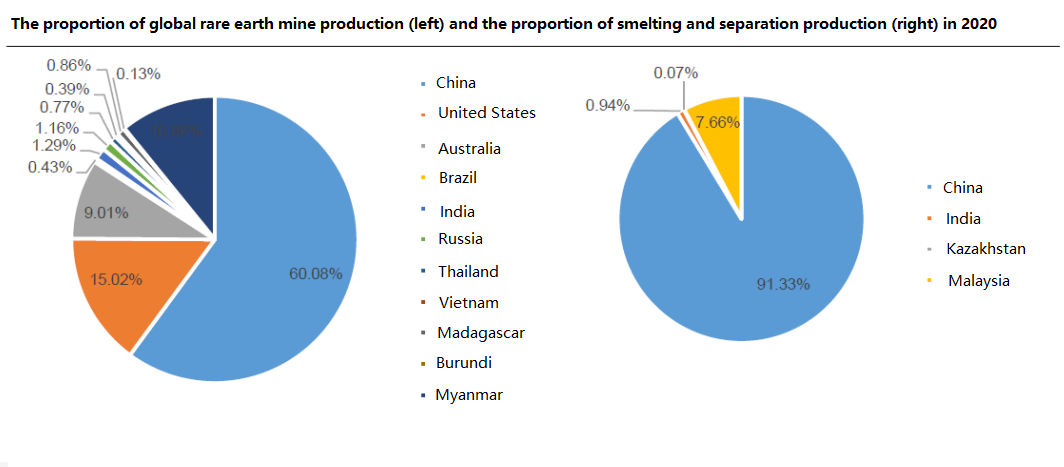

- Supply constraints are one of the main reasons for this round of rare earth prices. According to Antaike data, global rare earth mines (equivalent to REO) output in 2020 will be 233,000 tons, a year-on-year increase of 6.6%.

Analysis of the global production

capacity trend of rare earth mines

Supply constraints are one of the main

reasons for this round of rare earth prices. According to Antaike data, global

rare earth mines (equivalent to REO) output in 2020 will be 233,000 tons, a

year-on-year increase of 6.6%. The increase in output is mainly due to the

increase in Chinese quotas and the United States. At the full production of the

Mountain Pass mine, China and the United States produced 140,000 tons

and 35,000 tons respectively; other countries were affected by the epidemic to

varying degrees. Under the leadership of Lynas, Australia’s output was

basically flat at 21,000 tons, while Myanmar’s output was basically the same at

21,000 tons due to the epidemic. And the domestic situation affects the content

dropped from about 27,700 tons in 2019 to 25,300 tons, which has an adverse

impact on the production of medium and heavy rare earth mines. Other countries

are mainly Russia, Madagascar, etc., with an output of about 3,000 tons and

2,000 tons.

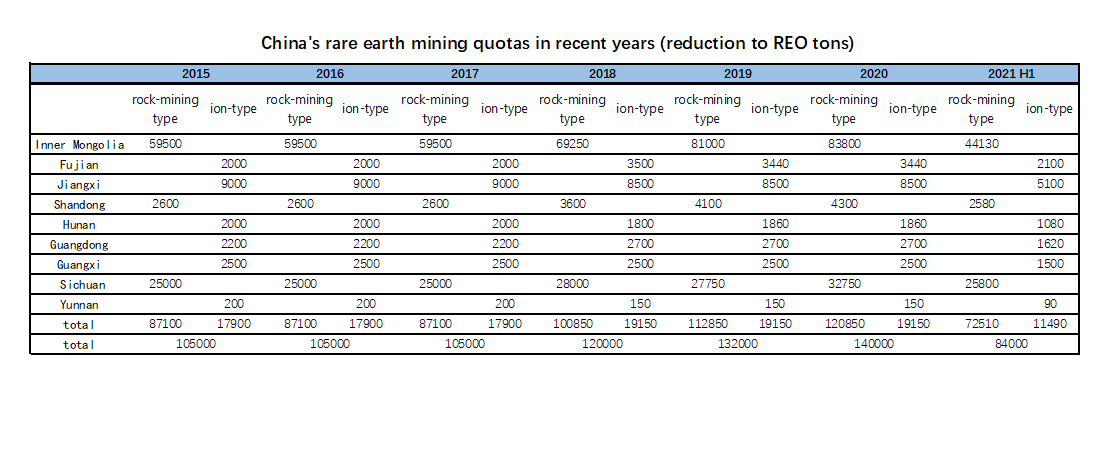

Domestic rare earth mines and smelting

separation volume is expected to increase steadily in 2021

The strong demand for rare earths in 2020

caused a mismatch between supply and demand and the continued increase in rare

earth prices are important reasons for the increase in rare earth mining quotas

in China, to prevent the sharp rise of upstream raw materials from harming the

industrial chain. The first batch of rare earth mining quotas issued by the

Ministry of Industry and Information Technology on February 18, 2021 increased

by 27.3% year-on-year to 84,000 tons of REO. If the quotas in the second half

of the year also increase in proportion, the annual mining quotas will increase

by 20% to 178,000 tons.

Domestic smelting separation quotas have

also increased in the same proportion. At the same time, overseas rare earth

mines have accelerated the resumption and mining progress under the stimulation

of high prices. It is expected that the global increase in rare earth mines

will mainly rely on domestic smelting capacity. According to our calculations,

the increase in overseas rare earth mines in 2021 is limited, and the Mountain

Pass mine in the United States is basically at full capacity. The increase may

mainly come from the Brown Mountain in the northern mining of the United

States; the Yandicoogina mine of Hastings in Australia The environmental permit

was obtained in April 2020, and the construction progress is expected to be

accelerated in 2021; Australia's Peak Resources Co., Ltd. is in the final stage

of mining approval in Ngualla Mining, Tanzania, and is expected to enter the

mining phase in 2021, but the overall increase in overseas rare earth mines The

quantity is limited.

We estimate that the global rare earth mine

(REO) output in 2021 will be 270,000-280,000 tons, a year-on-year increase of

about 20% from the 233,000 tons in 2020, of which the domestic output will

increase by about 38,000 tons, and the overseas increase will be about 10,000

tons. The overseas increase mainly comes from the gradual recovery of mines in

Australia and Myanmar, and the overall increase in US.