Search This Supplers Products:Magnetic materials, magnetic equipment and devicesAuto Partstelecom devicesElectronicselectricalsmetals

The Neglected Silicon Steel

publisherGordon

time2024/06/28

- Silicon steel is the core material of motors and transformers. It can be said as the most core material driving modern industry and is irreplaceable. Due to extremely high technical threshold, it has been monopolized by the world's industrial powers for a long time. China has been developing silicon steel for nearly 40 years, of which the first 20 years were mainly in the digestion and absorption stage. Last 10 years, it has achieved independent research and development and industrialization.

Silicon steel is the core material of motors and transformers. It can be said to be the most core material driving modern industry and is irreplaceable. Due to the extremely high technical threshold, it has been monopolized by the world's industrial powers for a long time. China has been developing silicon steel for nearly 40 years, of which the first 20 years were mainly in the digestion and absorption stage. In the past 10 years, it has achieved independent research and development and industrialization. The core technology, especially the production technology of high-end products, is mastered by Baowu group and Shougang. Overseas, only Nippon Steel and Posco have mastered the core technology of high-end products, and the supply rigidity is extreme. In the past two years, Chinese new energy industry has developed explosively, carbon peak and carbon neutrality have been gradually implemented, and the demand for industrial energy conservation has huge potential. The recovery of the global economy, especially the manufacturing industry, after the epidemic will also greatly increase the demand for silicon steel. It can be said that the downstream demand for silicon steel has ushered in a historic opportunity, and it coincides with Chinese great breakthroughs in high-end product technology. Chinese silicon steel development has ushered in a golden period. However, from the valuation of related companies, the value of such core varieties is seriously underestimated. The overall company valuation is less than 5 times, while magnetic material companies that are also mainly used to manufacture motors generally have a price-earnings ratio of more than 50 times.

Demand has ushered in a historic opportunity, and the high-grade non-oriented silicon steel required for new energy vehicles has increased dramatically.

Silicon steel can be divided into two categories: oriented and non-oriented. Oriented silicon steel has the highest technical threshold, followed by high-grade non-oriented, and finally medium and low-grade non-oriented. Oriented silicon steel is used in the transformer industry, with high added value but small total demand. Non-oriented silicon steel is used in the motor industry, with large volume and wide application. New energy vehicles use high-grade non-oriented silicon steel.

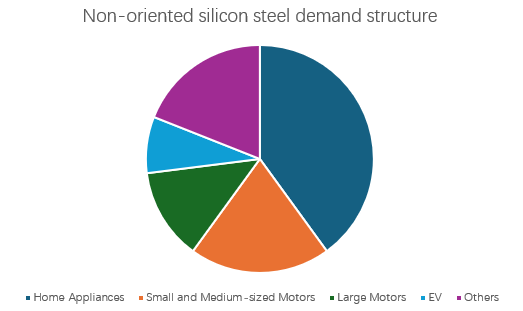

In 2020, Chinese downstream demand structure for non-oriented silicon steel will be 40% for home appliances, 20% for small and medium-sized motors in the industrial field, 13% for large motors, 8% for new energy vehicles and others.

Among them, to meet the dual carbon and energy control, the country encourages the improvement of energy efficiency levels of household appliances and industrial motors. In the future, the demand for high-grade non-oriented silicon steel in these fields will increase rapidly. The demand for high-grade non-oriented silicon steel required for new energy vehicles is expected to reach 800,000-1 million tons in 2025, with more than 5 times growth space.

The supply barriers of high-grade non-oriented silicon steel are extremely high, and the industry becomes highly concentrated.

In 2020, there were 18 companies in China capable of producing non-oriented silicon steel, of which only 8 were capable of producing high-grade products, and the output of the top five companies accounted for 89.09%. Considering that high-grade products have strict requirements on technology, capital, customer certification, etc., it is difficult for the market to form new supply companies in the short term. In the future, only two production companies such as Shougang will expand production, and it is expected that the new production capacity will be released in 2022 and 2023. About 700,000 tons. Among high-grade products, new energy vehicles have the highest requirements for product performance and specifications. Currently, there are only three companies with supply capabilities, and only Baosteel and Shougang have completed full vehicle certification. Overseas, only Posco (South Korea), Nippon Steel & Sumitomo Metal (Japan), and JFE (Japan) can supply silicon steel for new energy vehicles, but due to restrictions on the application market, production has not increased.

High-grade non-oriented silicon steel is an irreplaceable core material for new energy vehicle drive motors.

The drive motor is one of the three core components of new energy vehicles. Permanent magnet synchronous motors have the advantages of high efficiency, high torque density, small size, and light weight, and are the mainstream motors used in new energy vehicles. In addition to permanent magnets, silicon steel is also indispensable for core materials. The rare earth permanent magnets used in a new energy vehicle drive motor are generally worth about 1,200-1,600 yuan. The value of silicon steel consumed by a new energy vehicle drive motor is about 900-1,500 yuan, and the value of silicon steel and rare earth permanent magnets consumed by a single drive motor is comparable.

From the perspective of industry competition, the threshold for high-grade non-oriented silicon steel is much higher than the supply threshold for rare earth permanent magnets used in new energy vehicles. First of all, new energy vehicles have extremely high requirements for the performance of non-oriented silicon steel in terms of magnetic induction, iron loss rate, etc.; in addition, there are currently only three companies in China that have successfully supplied non-oriented silicon steel for new energy vehicles (Baosteel, Shougang, and TISCO). Although some other companies have initially achieved technological breakthroughs, the certification cycle of automobile companies is 4-5 years, and it is difficult to supply in the short term; on the other hand, the high concentration on the supply side has brought strong bargaining power to supply companies, and has a strong ability to transmit fluctuations in upstream raw material prices over a long period. Overseas, there are only Posco (South Korea), Nippon Steel & Sumitomo Metal (Japan), and JFE (Japan), but because only Chinese new energy industry is developing rapidly, the development speed of silicon steel for new energy overseas is very slow, and production capacity is even shrinking.

Therefore, regardless of the rigidity of supply and the prospects of demand applications, we believe that as an important raw material for driving motors, the corresponding market valuation of silicon steel is at least equivalent to that of rare earth permanent magnets, or even slightly higher.