Search This Supplers Products:Magnetic materials, magnetic equipment and devicesAuto Partstelecom devicesElectronicselectricalsmetals

Forecast of the market size of soft magnetic materials industry segments and the prospects of downstream application areas in 2024

publisherGordon

time2024/07/10

- Magnetic materials are basic materials close to the production and development of the national economy. They are widely used in the fields of electronics, information technology, energy and transportation, mechanical engineering, national defense and military industry, etc. According to different magnetic properties, magnetic materials can be mainly divided into permanent, soft and other functional magnetic materials such as moment magnetism, gyromagnetism, and pressure magnetism.

Forecast of the market size of soft magnetic materials industry segments and the prospects of downstream application areas in 2024

1. Analysis and forecast of market size of soft magnetic materials industry segments

Magnetic materials are basic materials closely related to the production and development of the national economy. They are widely used in the fields of electronics and electricity, information technology, energy and transportation, mechanical engineering, national defense and military industry, etc. Magnetic materials generally refer to strong magnetic substances composed of transition elements such as iron, cobalt, nickel, manganese, zinc and their alloys. According to different magnetic properties, magnetic materials can be mainly divided into permanent, soft and other functional magnetic materials such as moment magnetism, gyromagnetism, and pressure magnetism. Permanent magnetic materials have high coercivity and are difficult to magnetize. If magnetized, they are also difficult to demagnetize; soft magnetic materials have low coercivity and high magnetic permeability. Compared with permanent magnetic materials, they are easy to magnetize and demagnetize. They are usually used to manufacture various magnetic devices such as transformers and inductors to achieve power conversion, interference suppression and signal transmission.

According to the different materials and structures, soft magnetic materials can be divided into ferrite soft magnetic materials, metal soft magnetic materials and other soft magnetic materials. Each type of soft magnetic material has its advantages and disadvantages in performance and is complementary in application.

(1) Ferrite soft magnetic material market

Ferrite is an oxide soft magnetic material made of iron, manganese, zinc, nickel and other oxides by ceramic technology. It is used as the core of magnetic devices such as inductors and transformers. It is characterized by high initial permeability and high resistivity, so the internal induced eddy current loss is low in high-frequency environments, and it is suitable for use in broadband environments from tens of kilohertz to hundreds of megahertz. It is easy to process into various shapes, has a hard texture, and is resistant to acid and alkali corrosion, making it suitable for the manufacture of various transformers, inductors, etc. Ferrite soft magnetic materials can be subdivided into various types such as manganese zinc, nickel zinc, and magnesium zinc according to different components.

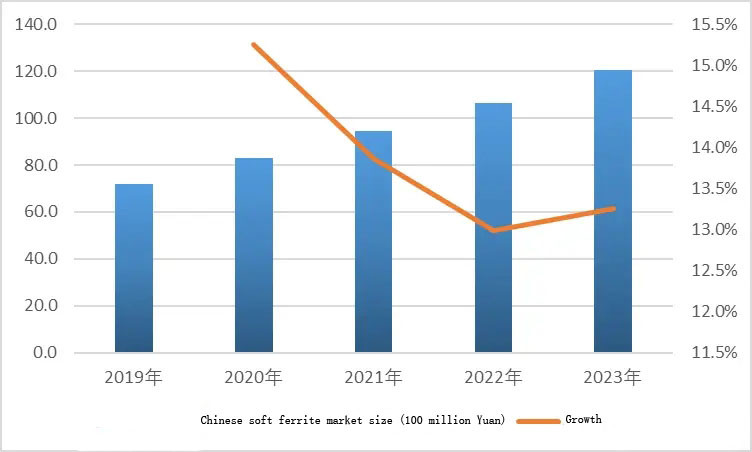

The market size of Chinese soft ferrite industry will grow from 7.18 billion yuan in 2019 to 12.06 billion yuan in 2023, with an average annual compound growth rate of 13.8%, much higher than the global growth rate. In the domestic soft ferrite market in 2023, manganese-zinc ferrite production accounted for the highest proportion, 69%, nickel-zinc ferrite production accounted for 11%, and magnesium-zinc ferrite accounted for about 8%.

(2) Metal soft magnetic materials market

Metal soft magnetic materials are composed of metals and metalloid elements such as iron, nickel, aluminum, nickel, molybdenum, silicon and their alloys. They mainly include traditional metal soft magnetic materials, metal magnetic powder cores, amorphous and nanocrystalline alloy soft magnetics, etc.

Definition and main characteristics of various types of metal soft magnetic materials

|

Type

|

Main Features

|

Application

|

|

Traditional soft magnet

|

Including laminations, permalloy, etc.

|

Lower resistance, higher magnetic core loss at middle and high frequency, narrow application frequency

|

|

Powder core

|

Made by powder metallurgy using Fe, Si, Al, Ni, etc.

|

Higher saturation flux density, excellent DC bias, good temp. stability, suitable for high current, high power working environments. Lower effective permeability, it’s not suitable for high permeability and mutual inductance coefficient transformer

|

|

Amorphous

|

Made by Fe, Si, B and other alloys

by rapid cooling |

Higher permeability, lower magnetic core loss, higher saturation flux density,

higher resistance, but higher in cost. |

Nanocrystalline | Formed by proper annealing process based on amorphous process |

The main methods for making metal magnetic powder cores include mechanical crushing, water atomization and gas atomization. Metal magnetic powder cores can be subdivided into various types according to their composition, including iron, iron silicon, iron silicon aluminum, iron nickel, iron nickel molybdenum, etc.

In 2023, global sales of metal magnetic powder cores will reach approximately US$830 million, and are expected to reach approximately US$2.45 billion in 2030, with an average annual compound growth rate of approximately 16.7% from 2023 to 2030.

2. Market analysis and forecast of main downstream application areas of soft magnetic materials industry

(1) Overview of direct downstream market development

Globally, with the vigorous development of terminal application fields such as global photovoltaics and energy storage, new energy charging facilities, automotive electronics, communications and data centers, industrial automation, and medical equipment, the global transformer and inductor market has also maintained strong growth.

In the domestic market, the electronic components industry, including magnetic devices such as transformers and inductors, has maintained steady growth in recent years. According to the statistics of the "14th Five-Year Plan for the Development of China's Electronic Components Industry", from 2015 to 2020, the overall sales of the Chinese electronic components industry increased from 149.35 billion yuan to 188.31 billion yuan, with an average annual compound growth rate of about 4.75%. my country has formed the world's largest production and sales scale, the most complete categories, and the complete industrial chain of electronic components industry system. In 2023, the overall scale of the electronic components industry will be about 216.41 billion yuan.

(2) Overview of the development of major downstream terminal markets

1) Photovoltaic and energy storage industry

Soft magnetic products represented by ferrite soft magnets are mainly used in the photovoltaic and energy storage industries for the production of magnetic devices such as transformers and inductors in photovoltaic inverters and energy storage inverters. Photovoltaic inverters are the core equipment of photovoltaic power generation systems, which can convert the direct current generated by photovoltaic modules into alternating current with power quality that meets the grid connection standards. The performance of photovoltaic inverters directly affects the power generation efficiency and operating stability of photovoltaic power generation systems. The structure of energy storage inverters is similar to that of photovoltaic inverters. Its main function is to realize the bidirectional conversion and flow of electric energy between batteries and power grids as needed. It is the core equipment of energy storage systems, and its performance directly affects the operating efficiency and stability of energy storage systems.

According to the ratio of photovoltaic modules to inverters, photovoltaic inverters can be divided into centralized inverters, string inverters and micro-inverters. String inverters have a wide power range and are compatible with distributed and centralized power generation scenarios. They have certain cost advantages in high-power application scenarios. The main soft magnetic raw material of their boost inductors is metal magnetic powder cores.

The micro inverter achieves voltage boost and isolation through the main transformer, which electrically isolates the photovoltaic modules from the power grid and minimizes safety hazards on the DC side during use and operation and maintenance. The magnetic material used in its main transformer is a soft ferrite core.

Compared with string inverters that require additional component disconnectors, micro inverters have shown better comprehensive advantages in cost and safety in the construction of photovoltaic power stations with a power range below 10kW. Its penetration rate is steadily increasing, and it is expected to have broad market prospects in the future.

Since my country has not yet officially implemented the mandatory safety standard for distributed photovoltaics to have a component-level shutdown, the domestic penetration rate of micro inverters is relatively low. The safety and economic advantages of micro-inverters in Chinese photovoltaic market will become apparent, and the domestic market is expected to become a new growth point for the micro-inverter market in the future.

In the next few years, the global photovoltaic installed capacity will enter a period of rapid growth, reaching 436GW-516GW in 2030. Based on the background of "carbon peak in 2030" and "carbon neutrality in 2060", the photovoltaic industry has broad long-term growth space. It is expected that between 2023 and 2030, China's average annual new photovoltaic installed capacity will exceed 100 GW.

With the dual trends of increasing safety requirements in various countries' policies and the gradual emergence of the economic benefits of micro-inverters, the micro-inverter market has broad prospects.

Photovoltaic is gaining popularity in the global market. Judging from the policy guidance of various countries, the development of highly secure distributed photovoltaic power generation will become an important trend in the future development of the photovoltaic industry. Among them, micro inverters with high security and cost-effectiveness are expected to usher in a booming market scale.

2) Automotive electronics and charging infrastructure industry

Soft magnetic materials are key raw materials in the automotive electronics industry and can be used in core magnetic devices such as transformers, step-up/step-down inductors, PFC inductors, and filter inductors in key electronic devices such as on-board chargers (OBCs), on-board DC-DC converters, and on-board inverters. They are also key raw materials in the new energy vehicle charging infrastructure industry and can be used to produce core magnetic devices such as charging pile power transformers and filter inductors.

Electrification, intelligence and networking have become important themes in the development of the automotive industry. The increase in the overall sales of new energy vehicles and the amount of electronic equipment per vehicle, as well as the growth in demand for supporting charging infrastructure, have jointly driven the growth in demand for soft magnetic materials.

3) Communications and data center industry

5G communication is showing a development trend of high frequency, high speed and large capacity. The power density of 5G base station power supply and server power supply system is high, which requires soft magnetic materials to have a series of excellent characteristics such as high saturation flux density, suitable for high power density, high-efficiency power conversion devices, and good low power consumption characteristics in a wide range of frequency, temperature and humidity. Driven by the construction of 5G base stations and data centers around the world, the market prospects of related high-performance soft magnetic materials are good.

Domestically, driven by favorable factors such as national policy support and increased corporate demand, the scale of Chinese data center market continues to grow rapidly. In 2023, the scale of Chinese data center market will reach about 250 billion yuan.

With the promotion of the national digital economy construction, the 5G communication and data center fields will continue to maintain rapid growth, and the development of communication technology will also drive the increase in demand for base station construction, replacement and supporting soft magnetic materials.